|

Everybody should look into how to obtain his or her lost funds from their local state. What we did here was go into https://ouf.osc.state.ny.us/ouf/, and believe it or not, we received a few hundred to a few thousand dollars per occurrence. The next interesting thing one can do with real estate, is to grieve property taxes every year. The next step is to hire a property tax attorney on a contingency basis. If the property tax attorney wins for a given tax year, the owner of the home will be responsible to pay the attorney 50% of tax winnings. Some properties we have tested have had property taxes reduced by about 50% or more. It's important to grieve property taxes every single year, as no payment is owed if the property tax attorney doesn't win. Please note that we do not receive any financial incentives for recommending this law firm, but we have had several success stories by using heller tax grievance.

Many organizations have issues in regards to how technology is currently managed. One perspective firm's should keep in mind is that always using the latest technology could be an issue because the labor associated to that technology is expensive, there is a short labor supply, and some of the older systems may or may not work with it. On the other hand, if one uses the oldest technology, technical debt will build up, there could over the years be a short labor supply to service that technology, and it will be expensive to replace. Most firms should follow the reversion to the mean approach, which is regarded as a methodology coined in capital markets for statistics, but can be used across all industries. This means that use average technology associated to the business problem because there is ample labor available, it's not too risky, and easy to maintain. The question should always be is this specific technology needed? Who will support it? How much will it cost? How much will my firm profit on? What business features are obtainable in this technical solution rather than other technical solutions? As always keep things simple, and business driven.

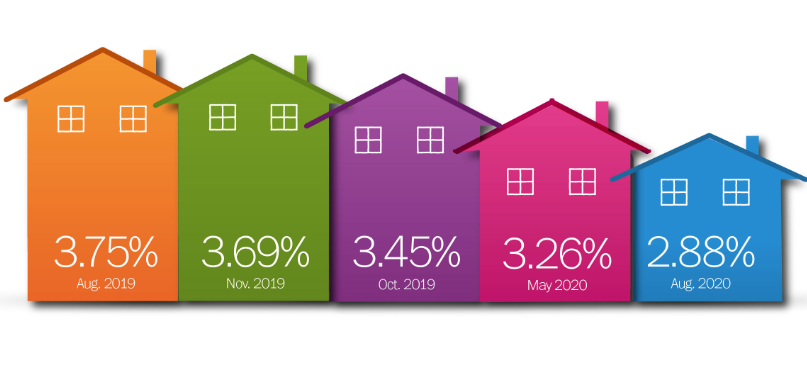

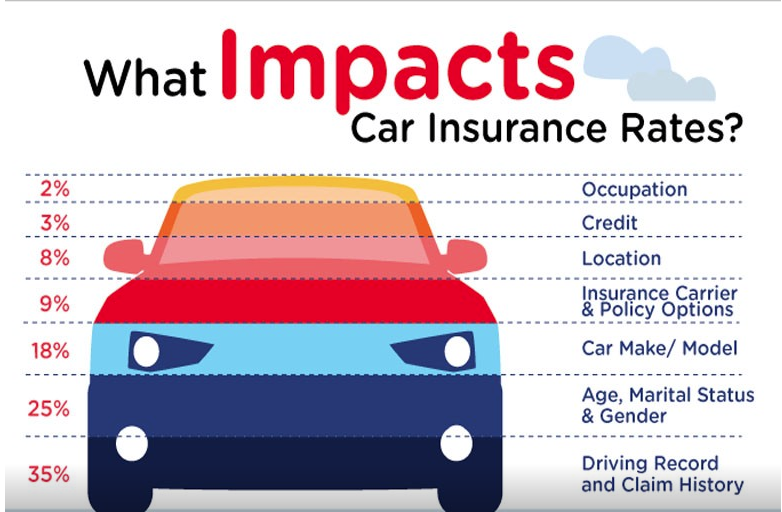

As always, we begin these posts to read the legal disclosure for any posts in regards to investments on our insights page. With interest rates for loans being close to 2.5% for a 30 year mortgage, one may be wondering where is the best place to invest right now? If you read how to minimize portfolio volatility, one can see Investment Science made a good call on bonds when the market tanked. According to Investment Lab, the best place for investments right now is commercial real estate, especially in NYC, and converting that into residential property. As Baron Rothchild once said, 'Buy when there's blood in the streets.' Investment Science feels that NYC will recover, but our firm does not know the exact year, and people always will need a place to live. Buy low sell high! We're not sure if this holds true across all states, but the cheapest insurance rates we were able to find in NY were from Esurance. Please note that anything we suggest on this insights page, we do not receive any financial incentives from any individual or company. It is vital for one to understand that while Allstate owns Esurance, Allstate typically cannot beat Esurance rates because Esurance is all online. Lastly, some factors that impact car insurance rates are your occupation, credit, location, policy option, car make, car model, age, marital status, gender, education level, driving record, and most importantly claim history. We do recommend that each and every individual takes the defensive driving course, as one can receive 10%+ off of their yearly premium for about three years. Does anybody know where to obtain the best insurance rates? We have literally called hundreds of places and nobody could beat Esurance in the state of NY.

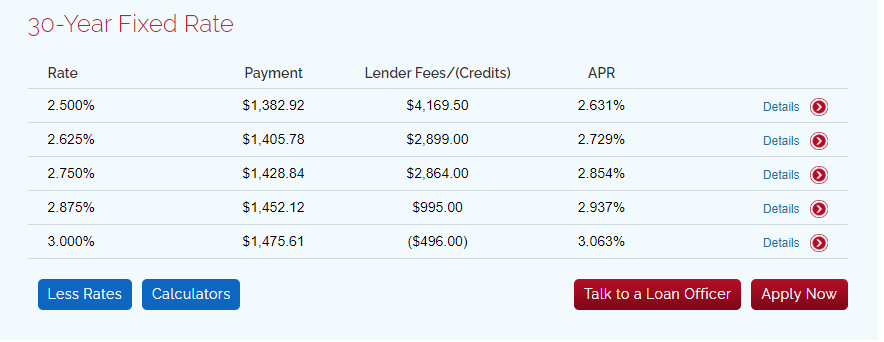

Too many consumers are relying on the wrong sources to obtain residential mortgages. Luckily for you, Investment Science, has the website to obtain the very best mortgage rates. Please note that if you do use them it could take an extremely long time, and you will be your own broker providing your own paperwork! However, once it's finished it's finished. We have done three transactions with this firm, and have not had any issues outside of slowness. What's very interesting is that money right now is close to being free! However, whenever rates are good, it usually means some type of economic disaster such as hurricane sandy, the financial crisis, or coronavirus. We will end with it is an excellent time to take on debt or refinance existing debt. Our lender of choice is aimloan, and note we do not receive any referral fees from them, but did all of the shopping for you from past experiences. If anybody knows of a better firm, please comment here, and we would be interested in investigating this. Lastly, if one is uncomfortable with an online lender, at least print out the rate sheet and see if your lender can beat it. Correlation is a bivariate analysis that measures the strength of association between two variables and the direction of the relationship. In terms of the strength of relationship, the value of the correlation coefficient varies between +1 and -1. A value of ± 1 indicates a perfect degree of association between the two variables.

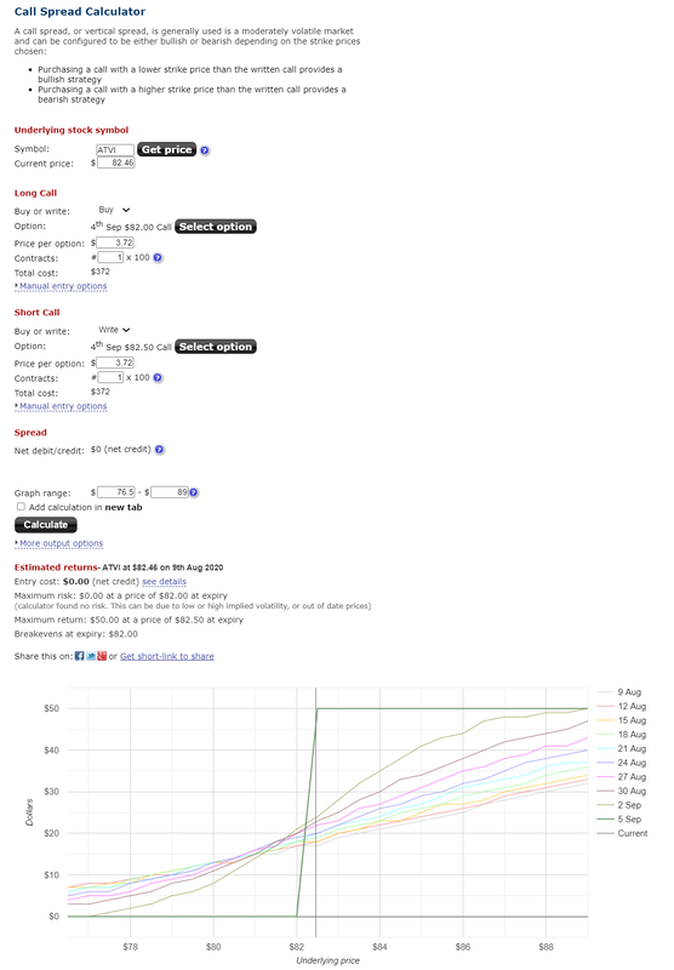

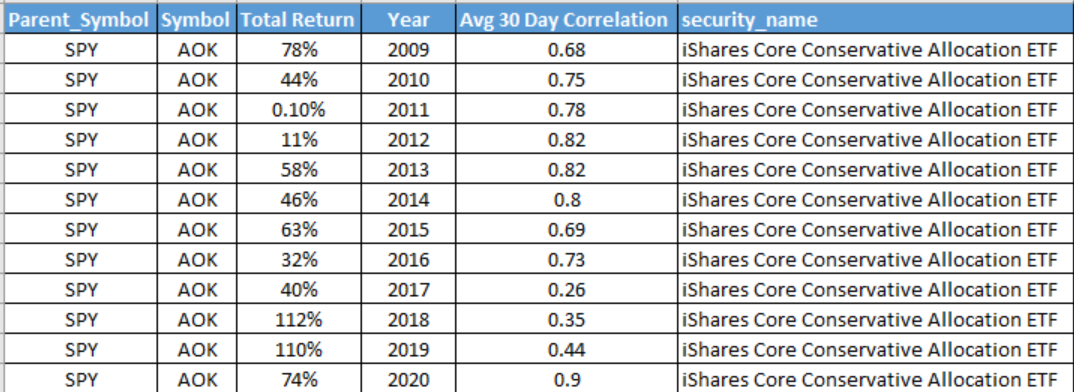

There are many things one can do with correlations of stocks in a portfolio. Ideally, every security one adds would not be related. Unfortunately, if you read how exposed are you in the next stock market crash? You will see just about everything moves together during panics because investors move into cash. Also, if you read limitations of financial models, you will also understand that most stocks are actually not normally distributed. Whenever correlations are measured, typically a 3 month rolling moving average is computed. For the purpose of this exercise, we just took a basket of securities, and calculated three separate correlations over one year. Ideally, everything in your portfolio shouldn't correlate together. Similarly, the correlations computed were Pearson (which unfortunately assumes a normal distribution), kendall, and spearman correlation. Investment Science prefers to take an average of the three measures of correlations. Similarly, each and every position should had a different time horizon (i.e. an investment one year from now or three months from now), a different strategy (some long positions, and some short positions). So many people we talk to are overly-concentrated in one sector or all long or all short. All of these things could lead to a disaster. Feel free to play around with the spreadsheet we created for Microsoft, and a hypothetical basket of securities. Our product, Investment Lab, did these computations. -See stats_expanded.xlsx We are building off of our previous post on the ticker symbol 'ATVI' or Activision Blizzard, which had a stock price of $82.46 on August 7th, 2020. Now, Investment Lab has functionality to graph opportunities for options, like we showed you on determining when an option is overpriced . What we do next, is check for inefficiencies of pricing within options. If we perform a credit spread trading strategy, where we sell a call option with the strike price of $82.50 on August 7th at $3.72, and we also buy a call option at $82.00 for $3.72 on August 7th - we would have a risk free trade, meaning if the price of ATVI is less than or equal to $82.00 we lose $0 dollars (see the last image for more detail).

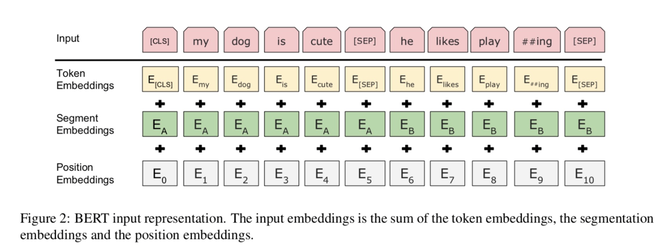

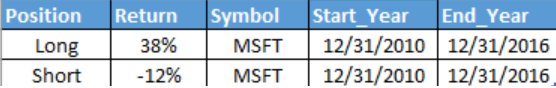

*Note due to transaction costs and slippage (With regard to futures contracts as well as other financial instruments, slippage is the difference between where the computer signaled entry and exit for a trade and where actual clients, with actual money, entered and exited the market using the computer’s signals) we would likely only lose $5-$10 dollars. Lastly, we based the pricing off of the mid price from the bid and ask of Activision Blizzard options. So to summarize, we risk $5-$10 dollars to make $50 dollars if Activision Blizzards stock price is greater than 82.50 on September 4th. Our software was able to pick the best risk/reward scenario for a given option at a given target price!  Pairs trading is when one takes multiple financial positions. A pairs trade is a trading strategy that involves matching a long position with a short position in two stocks with a high correlation (Having a “long” position in a security means that you own the security. Investors maintain “long” security positions in the expectation that the stock will rise in value in the future. ... Investors who sell short believe the price of the stock will decrease in value). What we did here was bounce off all of the data in our product coined 'Investment Lab,' and we find highly statistical correlated pairs that move together. In the event that the correlations break apart, we went long one position, and short another position. We take profit when the values approach two times the average true range (Average True Range (ATR) is a technical indicator measuring market volatility. It is typically derived from the 14-day moving average of a series of true range indicators. It was originally developed for use in commodities markets but has since been applied to all types of securities) is met with a trailing stop loss (A trailing stop loss is a type of day trading order that lets you set a maximum value or percentage of loss you can incur on a trade. If the security price rises or falls in your favor, the stop price moves with it. If the security price rises or falls against you, the stop stays in place). We found two ticker symbols that made profits every single year, inclusive of financial crashes!  Enhance Your Financial Portfolio with the Wilcox Model At our firm, we continually seek out unique and compelling data points to inform our financial instrument analysis. In developing the Wilcox Model, we have incorporated a diverse range of data, including astronomical phenomena such as star positions, sunspots, and moon cycles. While we maintain the proprietary nature of our algorithm, we can share that our back-testing of this model from 2010 to 2016 yielded an impressive 25% return. Although a 4% annual return might not seem extraordinary at first glance, what sets this strategy apart is its potential independence from broader stock market trends. Integrating a portion of your investment portfolio with the Wilcox Model could provide valuable diversification and risk mitigation. Understanding Back-Testing and Investment Positions Back-testing involves applying a trading strategy or analytical method to historical data to evaluate its effectiveness in predicting actual results. This rigorous process helps us ensure that our models are not only theoretically sound but also practically viable. When it comes to investment positions, maintaining a “long” position in a security means that you own the security, anticipating that its value will increase over time. Conversely, “short” positions are taken with the expectation that the security's price will decline. By leveraging advanced back-testing techniques and a keen eye for unique data points, the Wilcox Model offers a robust addition to any investment strategy. Enhance your financial portfolio's performance and resilience with our innovative approach (We back tested the results in python):  The purpose of this post is to give a firm a high-level strategy as to how one could conduct a language processing project. According to wikipedia, natural language processing is 'A subfield of linguistics, computer science, information engineering, and artificial intelligence concerned with the interactions between computers and human languages, in particular how to program computers to process and analyze large amounts of natural language data.' For now, we will first have to create a strategy around language processing. Subsequent posts will show some tutorials on how to conduct language processing in python on some real live data. For now, we are just giving you a pre-cursor on how to get started. Steps: 1) Select which model to use - For the purpose of this post, you could use the language processing model called 'BERT: Pre-training of Deep Bidirectional Transformers for Language Understanding.' The BERT model was created by Google in 2018, as a neural network (A neural network is a network or circuit of neurons, or in a modern sense, an artificial neural network, composed of artificial neurons or nodes) and is used for pre-training data. One needs to pre-train data for the model to have sufficient information to analyze subsequent data points to make decisions. What we want to point out is that when our firm conducts any type of data science projects, we choose the best model for you, based off of every single model available. Our findings have been that most individuals will just pick a random model to implement on a client side, but have not looked at other alternatives. Today, you may not be obtaining the best model for your business problem. How does the BERT model work? 1) All text that is entered into the model must be lowercase (as you can see in the figure below [if you are on mobile it is above] in red) 2) Tokenization must occur (Tokenization is a way of separating a piece of text into smaller units called tokens. Here, tokens can be either words, characters, or subwords) - please look at the yellow box below [if you are on mobile it is above] 3) Next, text segmentation must occur (segmentation is the process of dividing written text into meaningful units, such as words, sentences, or topics. The term applies both to mental processes used by humans when reading text, and to artificial processes implemented in computers, which are the subject of natural language processing. 4) The position embedding's must be applied (positional embedding's are used to encode order dependencies into the input representation. However, this input representation only involves static order dependencies based on discrete numerical information, that is, are independent of word content.) 5) In part II of this tutorial, we will select a programming language to conduct natural language processing with. We prefer python, which is a general purpose interpreted programming language. 6) We need to define what we are looking for. For the purpose of this tutorial, we will focus on negative news, so that we can determine whether or not a new piece of news is negative 7) Lastly, each tokenized text source will bounce off the corpus (https://www.english-corpora.org/wiki/), and generally will be given a computational output of the model as to how close the text is to the corpus to categorize the text. Typically, the Wikipedia corpus is used because the Wikipedia corpus contains the full text of Wikipedia, and it contains 1.9 billion words in more than 4.4 million articles. The corpus can also be a sub-set of data such as all negative news. We need to classify the corpus in order to determine whether or not a piece of news is negative. Stay tuned for the tutorial! |

AuthorMichael Kelly has been working within banking technology for over a decade, and his experience spans across algorithmic trading, project management, product management, alternative finance, hedge funds, private equity, and machine learning. This page is intended to educate others across interesting topics, inclusive of finance. Archives

July 2024

Categories

All

|

Insights

WHAT WE OFFER / WHO WE SERVE / ABOUT / PODCAST / INSIGHTS / CASE STUDIES / TESTIMONIALS / SAGEFUSION / CONTACT US

|

OUR OFFICE

|

SAY HELLO

If you are interested in working with us or just want to say hello simply drop us a line!

Email: [email protected] Phone: +1 (917) 512-9523 |

OUR INSIGHTS

Stay up to date with our latest content from our insights page.

|

RSS Feed

RSS Feed