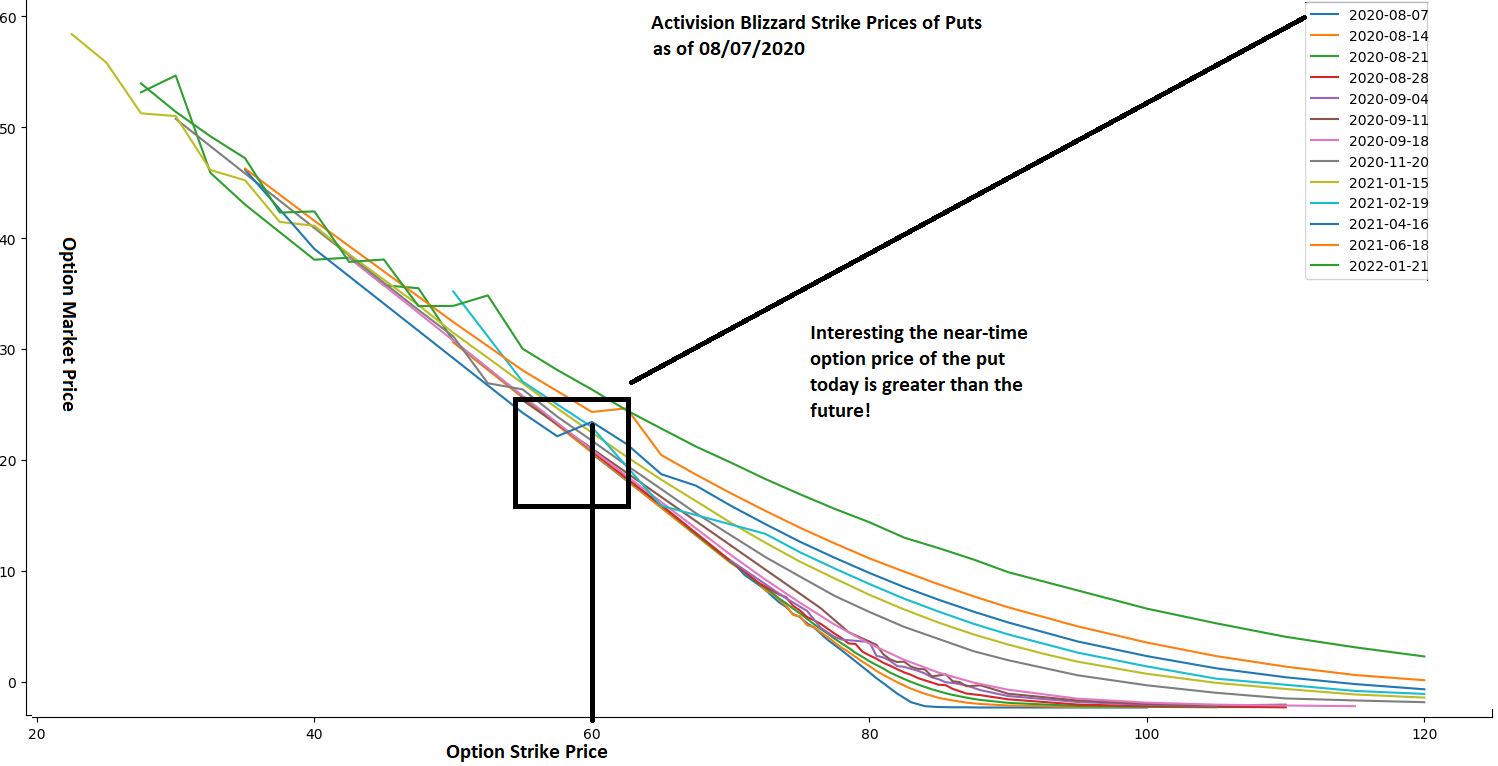

What is interesting about the graph above is on August 7th, 2020 the near-term price of the put option, that expired on August 7th, is worth more than the other option prices into the future. Simply speaking, when there are no economic events (such as a company merger or a corporate earnings event) one would expect the derivatives price on 08/07/2020 (i.e. today) for the company, Activision Blizzard (Ticker symbol ATVI), to be less than the future option prices. - but it's not!

Now that you understand this post, please go to our next post on Options Trading Arbitrage

RSS Feed

RSS Feed