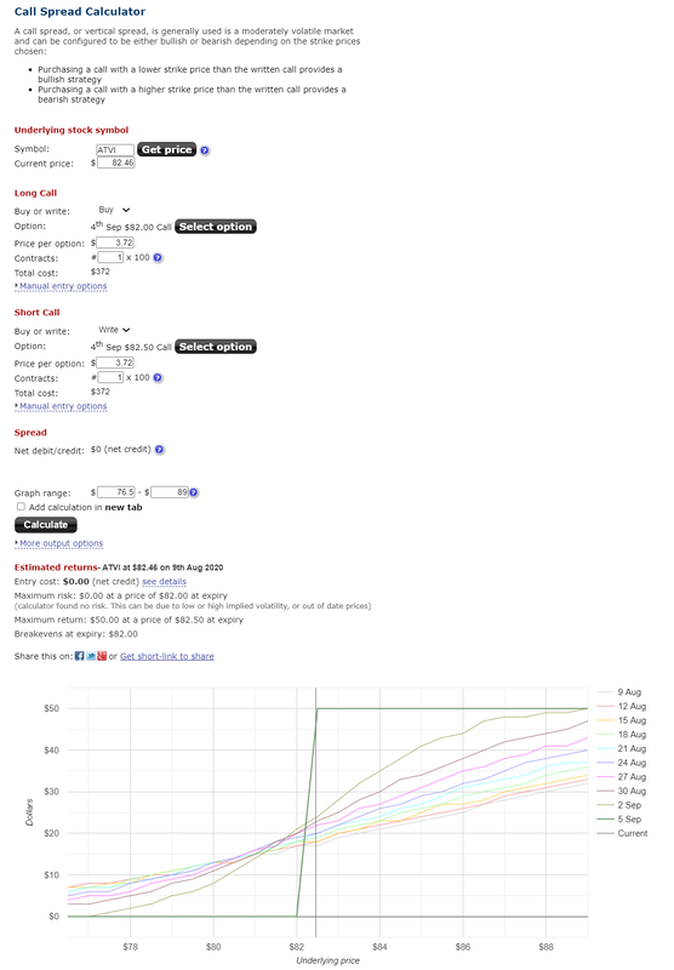

*Note due to transaction costs and slippage (With regard to futures contracts as well as other financial instruments, slippage is the difference between where the computer signaled entry and exit for a trade and where actual clients, with actual money, entered and exited the market using the computer’s signals) we would likely only lose $5-$10 dollars. Lastly, we based the pricing off of the mid price from the bid and ask of Activision Blizzard options.

So to summarize, we risk $5-$10 dollars to make $50 dollars if Activision Blizzards stock price is greater than 82.50 on September 4th. Our software was able to pick the best risk/reward scenario for a given option at a given target price!

RSS Feed

RSS Feed