This post is a re-post from altova's blog in regards to how inaccurate publicly available financial data is for consumers. We have worked for many premier financial institutions, and the data quality across all products in regards to accounting is quite an eye-opener.

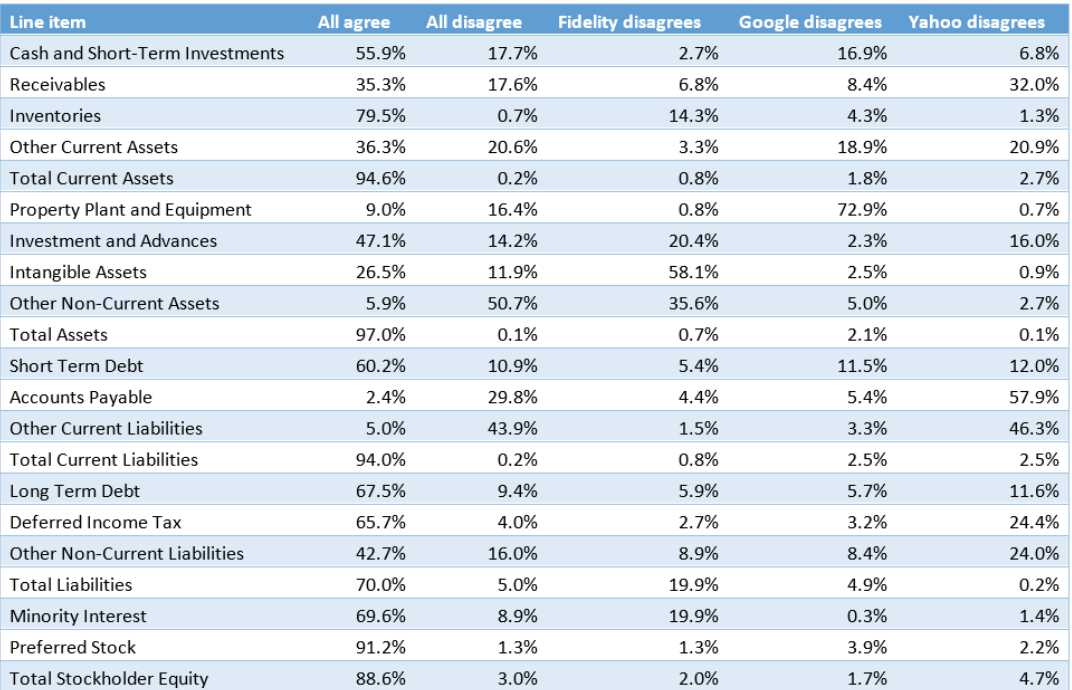

The table below shows each line item on a firms financial balance sheet. For example, 'Other Current Liabilities', on the firms balance sheet would show the other current liabilities for a given firm. The data sources for the table are Fidelity, Google, and Yahoo. This means if one were to go to google's website for every publicly traded firm in the United States, that 43% of the data for current liabilities, on the balance sheet, does not match the data displayed on Fidelity and Yahoo. Investment Science has spent three years in processing xbrl data directly from the government, which means we could analyze whether or not your firm's financial applications are actually publishing accurate accounting information.

RSS Feed

RSS Feed