|

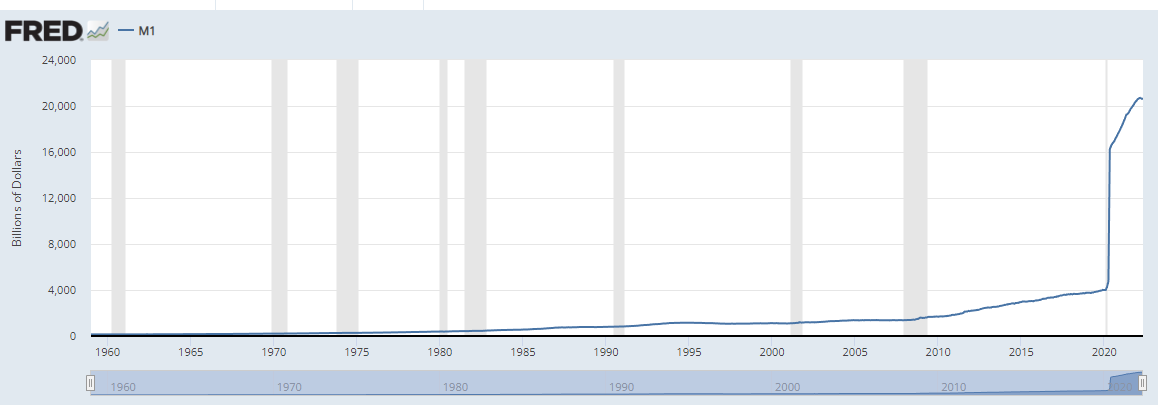

Everyday prices such as food, housing, and gas have gone up quite substantially in 2022. Food in The United States has gone up about 10% compared to 2021, but some constituents are reporting takeout food pricing increasing by 30%. Similarly, housing has gone up an additional 10% in 2022 largely in part that The United States needs to produce 1.5 million homes per year, and has been unable to do so for over a decade, even in a normal economy. Add in supply chain issues, and raw materials taking an additional six months to ship, one could argue it's a recipe for house prices to be sticky in nature. Additionally, many individuals and corporations refinanced in 2020 to a 2.5% interest rate, and with interest rates rising, it leaves very little motivation for individuals to move out of existing real estate. Since new purchasers cannot afford new housing, the demand for rentals will increase. Additionally, the Federal Reserve continues to raise interest rates, which increases HELOC borrowing costs on landlords, who pass those cost down to consumers. Additionally, the price of oil went negative in 2020, and is currently at unsustainable levels in the long-term. This triple-entente is not good for consumers to spend, on top of corporations tightening the purse strings of a looming recession. One case study many individuals forgot about is when Europe embraced the Euro. When Europe embraced the Euro, many countries such as the Netherlands had their old currency price, but a Euro in front of it with the new currency, which was much higher in value. Real estate will continue to go up, food prices will be sticky, and gas will be back down to normal prices in the next two years. This means that employers will have to pay higher wages in order to attract talent, and many countries not experiencing high food prices, may exhibit a larger immigration influx. Just remember whenever prices are out of whack, like they were with Bitcoin in 2021, they eventually go back down to reality, due to reversion of the mean principle. On the other hand, housing and food prices tend to be sticky (outside of the 2008 crises). It is notable to consider the M1 money supply has not gone down, and increased by 500% from 2020. These prices will be offset by firms cutting spending, consumers cutting spending, and the prices will revert back to the mean at a more acceptable level with the political elections being a catalyst to more sustainable pricing for all.

More often than not, our firm receives a fair number of asks in regards to capital raising, as well as capital introductions. Prior to any firm receiving capital, the founder should be aware that if they are seeking capital from venture capital that he or she needs to understand:

1) Does the venture capitalist even invest in the area that the company is in? I.e. do not go to a venture capital that does deep tech artificial intelligence investing when your firm is a regulatory agency. 2) Understand at which stage the venture capitalist invests? I.e. SEED, Series A? Do not go into a Series A investor asking for Seed. 3) Understand much capital does the venture capitalists fund have? I.e. $100 million? $10 million? 4) Understand from question #3 how much of that capital has already been deployed? I.e. $10 million/$100 million? This shows if this venture capitalist is just kicking the tires, and not serious. 5) From question #4 also ask them how quickly do they deploy capital? I.e. be prepared to offer them something generous in return or look at it from there perspective in what they would actually invest in. While these questions are not the exhaustive list, it's also important to notate that many venture capitalists lose money 9/10 times, and there are alternative measures of funding. If you'd like to find out more, please schedule a free consultation with us. Many companies, startups, and individuals, unfortunately, follow what we would coin a 'Euphoria' buying pattern. Let it be Peloton being overly optimistic about sales, then missing the sales targets without realizing that the sales patterns were associated with a short-term boon of COVID-19. Next, let's get into residential real estate, as it's in a bubble, and our firm does not predict individuals will be back in the office until 2024, which in turn would mean a boon to the cities around 2024. Similarly, Bitcoin in the long-term will have the price go down to zero, but blockchain technology will still exist, as it's a good solution for identity recognition. This also means many venture capitalists diving into firms that use blockchain and machine learning fail to realize that software such as Interactive Brokers works just fine and already allows individuals to trade crypto-currency, so more often than not, there's nothing proprietary in the market, and these investors will, unfortunately, continue to lose their investment 9/10 of the times.

Similarly, all people should know that crypto-currency is not much different than any type of fiat currency, such as the U.S. dollar because Bitcoin in its very nature is backed by nothing. Bitcoin is in a bubble that is already bursting, and we anticipate it to be gone completely within ten years due to China banning it, as well as other government agencies foreseeably into the future. Prices have all one thing in common, which is a reversion to the mean. Firms should always price in recessions, and not be overly optimistic as they were when mass hiring occurred in 2019, as well as a subsequent mass-firing in 2020. In short, our mid-term trend analysis as defined as the end of 2024 is bitcoin continuing to crash, cities returning to normal, residential housing prices starting to go to normal, and companies that had a boon from COVID-19 having their prices go back to normal. Legal Disclaimer: This post does not constitute an endorsement or recommendation to buy or sell a security, as well does not reflect any customer of Investment Sciences' opinions and is for educational purposes only. Save Business from Lost RevenueThe Covid-19 pandemic has hit many small institutions that unfortunately did not receive adequate capital from the PPP loan, and many landlords were hit particularly hard in regards to the pandemic with little to no solutions. Luckily for our clients and readers, we have come across a loan for landlords and companies still residing in NY. To qualify for this loan, we have created a checklist for you below, and we do not receive any money from this post.

To Qualify:

To qualify for this five year loan, please visit https://esd.ny.gov/ . We hope this helps everybody recover gracefully from the Covid-19 pandemic. Best Investment Mortgage ratesThis blog post was featured in Citizens Journal.

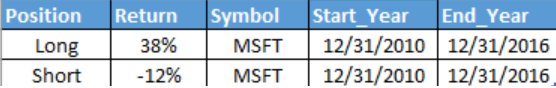

Former Treasury Secretary Larry Summers has railed against the latest $1.9 trillion dollar pandemic relief package. Combined with the two passed in 2020, he warned, they could overheat the economy and lead to inflation thus forcing the Fed to raise interest rates, which in turn could cause a recession. Summers raises a valid point in that the Fed is almost out of options; if the economy overheats, the Fed would have to raise rates. However, many need to take into account the financial impact of the pandemic with 9.5 million people still out of work. The total $4.5 trillion dollars in financial assistance is more palliative than stimulative. Funds were allocated to replace the lost economic activity and to keep the wheels of commerce turning to keep people in their homes. 2020 marked a record low number of homes in foreclosure because of the CARES Act. Millions of homeowners entered and exited mortgage forbearance programs, either catching up on back payments or changing the payment terms of their loans. The Federal Reserve has managed interest rates and aided homeowners and lenders by purchasing mortgage-backed securities. Summers needs to recognize just how dovish the Federal Reserve is on interest rates. The Fed holds $7.5 trillion dollars on its balance sheet with more than $2.5 trillion added since March of 2020, which almost guarantees low interest rates for years to come. Inflation will not be an issue unless the Fed changes the way it computes consumer costs through the Consumer Price Index (CPI), the selective counting of goods and services consumed in the current time period. Today the CPI, unfortunately, does not include real estate, energy, healthcare costs, education costs, stock market percentage increases or food prices. Of the three basic needs in life—food, clothing and shelter—it only fully counts clothing. While many would argue that food, stocks, healthcare, and energy prices can fluctuate for a variety of reasons—political unrest, droughts, floods, hurricanes, a cargo ship stuck in the Suez Canal—there should be a separate measure of inflation that calculates into a single bucket of food, housing, healthcare, and stock market percentage increase to actually see the real-world impact of economic policies of ultra low-interest rates. If such a measure did exist, Summers is partially correct that all of the stimulus incurred has actually increased the cost of everyday living for all citizens, and that these stimulus’ can cause individuals to mal-invest capital into overpriced assets that were caused by the federal reserve’s economic policies, such as the fact in the past economic recession. If housing prices were counted among other missing elements, inflation would certainly be on the rise. It seems oxymoronic that the CPI is used to factor in raising or lowering interest rates that affect housing purchases, while at the same time the cost of the houses purchased is not included. The rationale behind the exclusion of the largest single purchase in most consumers’ lifetime is that the payment for said purchase is spread out over years. New car prices are included, and those payments are spread over years. The fact of the matter is that the Fed has been trying to achieve inflation for the past decade, but it has struggled for a number of reasons. First—and one that not many people are talking about—is that many millennials are not having children, and population growth is stagnant. Ahead of the full report, the U.S. Census says that between July 2019 and July 2020, the U.S. population only grew 3.5%, the lowest growth since 1900. This is similar to the lost decade of Japan with its population issues and ultra low interest rates. The second reason is the growth of technology. India is now the #5 economy in the world, and it’s largely IT-focused, particularly in regards to automation, which increases productivity, thus lowering inflation in the US consumer market and globally. The third reason is Amazon, which is a global inflation-killer. Because there are no storefronts, Amazon significantly reduces operating costs, thus undercutting brick-and-mortar retailers. The stimulus was required to keep individuals in their homes, but part of the symptom of low inflation is ultra low-interest rates because the cost of everyday goods and services is rising rapidly. Many people are choosing not to have children because of this. The Fed in turn continues to keep ultra low-interest rates, which will perpetuate population issues and asset price increases, such as bitcoin and real estate where individuals mal-invest capital from artificial price increases. Once the economic policies end to keep individuals in their homes, the foreclosures will, unfortunately, begin to occur. Likewise, bitcoin is technically an inflation hedge, which may approach $100,000 in the near future, which is defined as one to three years from now, but will also crash similar to 2017 because all things in life revert back to the average. In short, Summers is simply stating that if the Fed needs to raise rates, deflation will occur, which is worse than inflation. The economic policies of the Fed are continuing to create asset bubbles and make everyday goods and services affordable. However, they did do something right compared to the previous crises by acting swiftly. The Fed’s swift responses have allowed institutions to take on debt with a low interest rate, keeping some people at work who would have otherwise lost their jobs. Michael Kelly, the founder of Investment Science, is an economist and financial consultant.  Enhance Your Financial Portfolio with the Wilcox Model At our firm, we continually seek out unique and compelling data points to inform our financial instrument analysis. In developing the Wilcox Model, we have incorporated a diverse range of data, including astronomical phenomena such as star positions, sunspots, and moon cycles. While we maintain the proprietary nature of our algorithm, we can share that our back-testing of this model from 2010 to 2016 yielded an impressive 25% return. Although a 4% annual return might not seem extraordinary at first glance, what sets this strategy apart is its potential independence from broader stock market trends. Integrating a portion of your investment portfolio with the Wilcox Model could provide valuable diversification and risk mitigation. Understanding Back-Testing and Investment Positions Back-testing involves applying a trading strategy or analytical method to historical data to evaluate its effectiveness in predicting actual results. This rigorous process helps us ensure that our models are not only theoretically sound but also practically viable. When it comes to investment positions, maintaining a “long” position in a security means that you own the security, anticipating that its value will increase over time. Conversely, “short” positions are taken with the expectation that the security's price will decline. By leveraging advanced back-testing techniques and a keen eye for unique data points, the Wilcox Model offers a robust addition to any investment strategy. Enhance your financial portfolio's performance and resilience with our innovative approach (We back tested the results in python): |

AuthorMichael Kelly has been working within banking technology for over a decade, and his experience spans across algorithmic trading, project management, product management, alternative finance, hedge funds, private equity, and machine learning. This page is intended to educate others across interesting topics, inclusive of finance. Archives

July 2024

Categories

All

|

Insights

WHAT WE OFFER / WHO WE SERVE / ABOUT / PODCAST / INSIGHTS / CASE STUDIES / TESTIMONIALS / SAGEFUSION / CONTACT US

|

OUR OFFICE

|

SAY HELLO

If you are interested in working with us or just want to say hello simply drop us a line!

Email: [email protected] Phone: +1 (917) 512-9523 |

OUR INSIGHTS

Stay up to date with our latest content from our insights page.

|

RSS Feed

RSS Feed