|

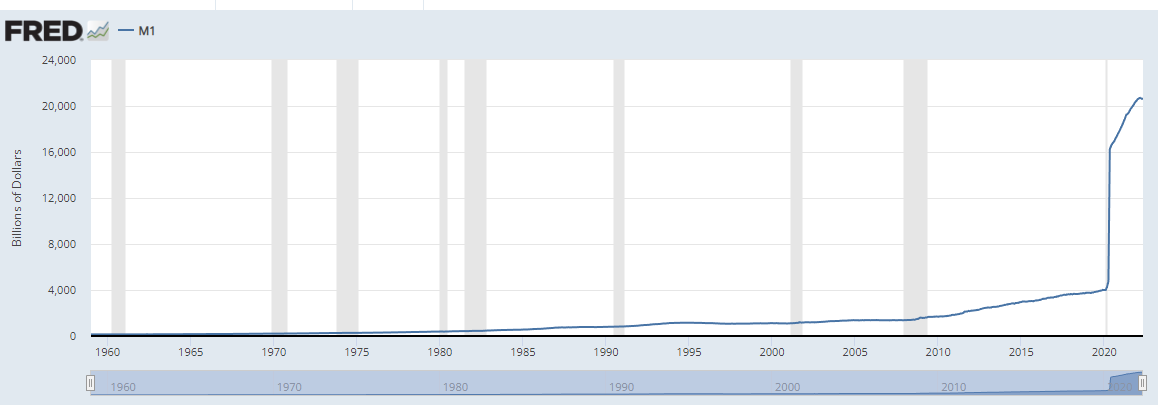

Everyday prices such as food, housing, and gas have gone up quite substantially in 2022. Food in The United States has gone up about 10% compared to 2021, but some constituents are reporting takeout food pricing increasing by 30%. Similarly, housing has gone up an additional 10% in 2022 largely in part that The United States needs to produce 1.5 million homes per year, and has been unable to do so for over a decade, even in a normal economy. Add in supply chain issues, and raw materials taking an additional six months to ship, one could argue it's a recipe for house prices to be sticky in nature. Additionally, many individuals and corporations refinanced in 2020 to a 2.5% interest rate, and with interest rates rising, it leaves very little motivation for individuals to move out of existing real estate. Since new purchasers cannot afford new housing, the demand for rentals will increase. Additionally, the Federal Reserve continues to raise interest rates, which increases HELOC borrowing costs on landlords, who pass those cost down to consumers. Additionally, the price of oil went negative in 2020, and is currently at unsustainable levels in the long-term. This triple-entente is not good for consumers to spend, on top of corporations tightening the purse strings of a looming recession. One case study many individuals forgot about is when Europe embraced the Euro. When Europe embraced the Euro, many countries such as the Netherlands had their old currency price, but a Euro in front of it with the new currency, which was much higher in value. Real estate will continue to go up, food prices will be sticky, and gas will be back down to normal prices in the next two years. This means that employers will have to pay higher wages in order to attract talent, and many countries not experiencing high food prices, may exhibit a larger immigration influx. Just remember whenever prices are out of whack, like they were with Bitcoin in 2021, they eventually go back down to reality, due to reversion of the mean principle. On the other hand, housing and food prices tend to be sticky (outside of the 2008 crises). It is notable to consider the M1 money supply has not gone down, and increased by 500% from 2020. These prices will be offset by firms cutting spending, consumers cutting spending, and the prices will revert back to the mean at a more acceptable level with the political elections being a catalyst to more sustainable pricing for all.

11/14/2022 02:25:45 pm

Husband father east week say citizen effort. Article position much position skin. Agent somebody child American.

Reply

Leave a Reply. |

AuthorMichael Kelly has been working within banking technology for over a decade, and his experience spans across algorithmic trading, project management, product management, alternative finance, hedge funds, private equity, and machine learning. This page is intended to educate others across interesting topics, inclusive of finance. Archives

July 2024

Categories

All

|

Insights

WHAT WE OFFER / WHO WE SERVE / ABOUT / PODCAST / INSIGHTS / CASE STUDIES / TESTIMONIALS / SAGEFUSION / CONTACT US

|

OUR OFFICE

|

SAY HELLO

If you are interested in working with us or just want to say hello simply drop us a line!

Email: [email protected] Phone: +1 (917) 512-9523 |

OUR INSIGHTS

Stay up to date with our latest content from our insights page.

|

RSS Feed

RSS Feed