Enhance Your Financial Portfolio with the Wilcox Model

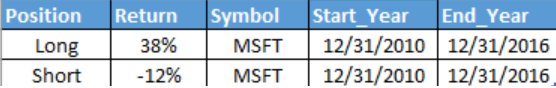

At our firm, we continually seek out unique and compelling data points to inform our financial instrument analysis. In developing the Wilcox Model, we have incorporated a diverse range of data, including astronomical phenomena such as star positions, sunspots, and moon cycles. While we maintain the proprietary nature of our algorithm, we can share that our back-testing of this model from 2010 to 2016 yielded an impressive 25% return.

Although a 4% annual return might not seem extraordinary at first glance, what sets this strategy apart is its potential independence from broader stock market trends. Integrating a portion of your investment portfolio with the Wilcox Model could provide valuable diversification and risk mitigation.

Understanding Back-Testing and Investment Positions

Back-testing involves applying a trading strategy or analytical method to historical data to evaluate its effectiveness in predicting actual results. This rigorous process helps us ensure that our models are not only theoretically sound but also practically viable.

When it comes to investment positions, maintaining a “long” position in a security means that you own the security, anticipating that its value will increase over time. Conversely, “short” positions are taken with the expectation that the security's price will decline.

By leveraging advanced back-testing techniques and a keen eye for unique data points, the Wilcox Model offers a robust addition to any investment strategy. Enhance your financial portfolio's performance and resilience with our innovative approach

(We back tested the results in python):

RSS Feed

RSS Feed